The recording industry has grown by 10.4% in the first half of 2025

The recording industry presents today its usual review of the first half of the year and Promusicae , the entity that groups more than 95% of the Spanish recording market , has published the figures recorded in the first six months of 2025. Taking advantage of the occasion, the report that the entity presents annually "X-ray of the recorded music market 2024" is made public, in which it presents in a grouped manner the figures of the previous year, in our country and in the world, analyzing them and drawing conclusions from the current situation of recorded music in Spain and the challenges and opportunities it faces.

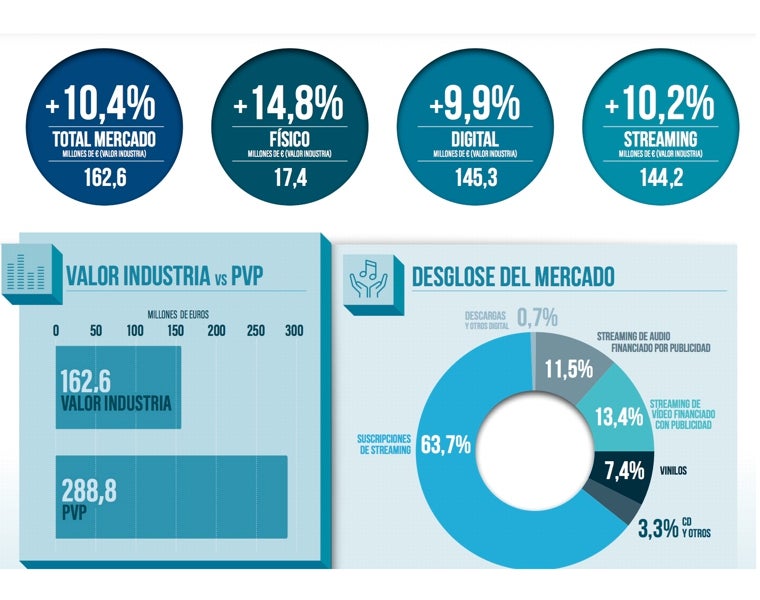

On this occasion, the figures presented by Promusicae are published in "Industry Value" (excluding VAT and distribution margins) instead of in RRP (as has traditionally been the case), in line with the way they are presented internationally.

The Spanish music market's robust performance is confirmed by the fact that from January to June 2025, it will generate revenues of €162.6 million in "industry value," which, translated into retail prices, would represent €288.8 million spent on the consumption of recorded music in Spain in its various formats.

The first half of 2025 brought renewed growth to the music industry, thanks primarily to the rise of the digital market, which continues to show very positive development with a 9.9% increase, driven primarily by streaming, which accounts for 99.2% of digital consumption .

The physical market has shown significant growth in the first half of 2025, recording a 14.8% increase, due to the significant growth in vinyl sales (25.6% compared to the same period last year), with a slight decrease in sales of compact discs (-3.2%) and other formats (-34.9%).

The strong growth rate of recorded music during the first half of 2025 is primarily due to digital consumption, which contributed €145.2 million (and 9.9% growth compared to the same period in 2024), accounting for 89.3% of total industry revenue. Within this consumption segment , streaming remains the star, contributing 88.6% of the total industry value, with €144.2 million and a 10.2% growth compared to the first half of 2024.

By type, paid streaming subscriptions represent industry revenue of €103.7 million (72% of total streaming revenue), while advertising-funded audio and video subscriptions contribute €18.6 million and €21.8 million respectively (a combined 28%). As highlighted in the Recorded Music Market Snapshot 2024, despite the continued growth in the adoption of subscription models, we are still far from the penetration rates of paid subscriptions seen in our peer countries, which are proving to be the key to consolidating digital growth and maintaining a healthy and powerful industry internationally.

As for the rest of the digital market, ongoing downloads continue to decline (-0.5%, contributing just €0.8 million), while mobile products are down 40.5% compared to 2024, contributing €0.4 million.

The significant growth in vinyl sales in the first half of 2025 (up 25.6% compared to the same period in 2024), contributing almost €12 million and accounting for 68.8% of sales in physical formats, makes this format the most attractive for bringing fans and superfans closer to the music of their favorite artists in a tangible way, strengthening their connection with them. CD sales, meanwhile, fell slightly compared to the first half of 2024, by 3.2%, contributing €5.34 million to the total market.

Antonio Guisasola, president of Promusicae , confirms the sector's satisfaction with the figures for the first half of the year: "Seeing through data that recorded music in Spain maintains its growth rate above 10.4% is good news for the sector, as it translates into a return on investment the tireless work of artists and record companies to offer the best songs and albums to the public in a highly competitive market."

For Guisasola, "it's more than confirmed that streaming is the current form of consumption, which sustains the record market, although we mustn't forget that the public continues to show great interest in physical products, especially vinyl, which are quality items that connect artists and fans." He adds that, "as evidenced in the X-ray of the recorded music market, the record industry faces challenges and opportunities to continue growing and recovering the levels of the 2000s, so that Spanish music has its rightful place internationally, and to face the challenges that Artificial Intelligence is placing before us. For all of this, we need, in addition to maintaining public support, the commitment of public authorities, so that they support and implement support measures for the sector, such as tax incentives for Spanish record production, or ensuring that intellectual property legislation is complied with regarding the use of protected works by AI developers."

ABC.es